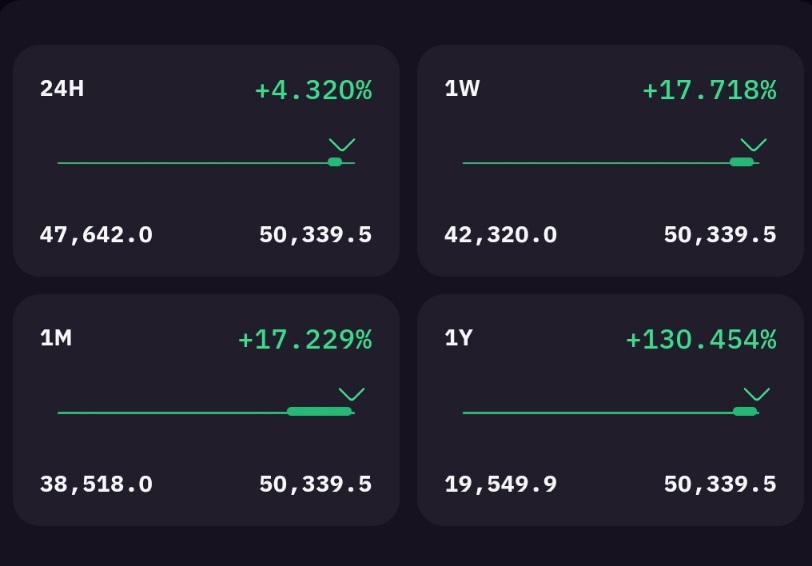

Celebrate love & Bitcoin’s remarkable rise! ❤️🚀 From fractions of a cent in 2009 to over $50,000 today, join us as we look back at #BTC price on Valentine’s Day since its inception. A story of innovation, resilience, and potential. Happy #ValentinesDay #BitcoinLove 💕💫

Category: Featured

Bitcoin $50K Milestone – Brace for Skyrocketing Prices as Hyperinflation Looms.

Bitcoin breaches the $50K mark, proving Jack Dorsey’s ‘fear’ of hyperinflation isn’t misplaced. Discover how absolute scarcity sets BTC apart from traditional assets & fuels long-term growth.

$50,000 Bitcoin Milestone Reached – Will $57,500 Be Next? Analysis and Outlook

💥 #BREAKING: #Bitcoin Blasts Through $50,000 Resistance! 🚀 Will $57,500 Be THE NEXT BIG THING?! Find Out Now!

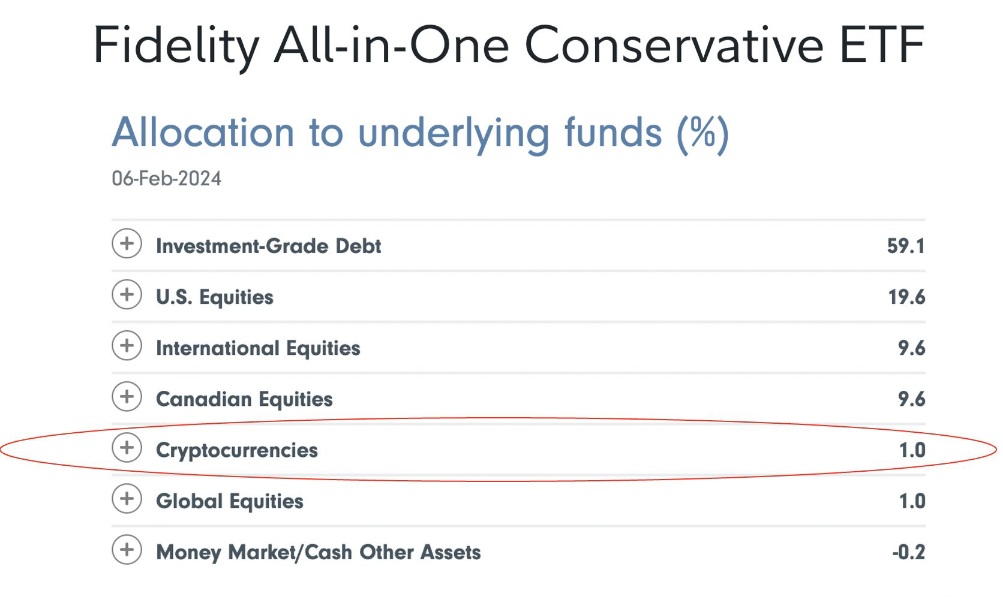

The Second Big Bang of Bitcoin: Institutional Adoption Accelerates

Watching history unfold! Fidelity Canada adds Bitcoin allocations to their All-in-One ETFs, marking a massive step forward in mainstream adoption. Feel like we’re experiencing the second big bang of BTC 🚀 Bullish beyond measure!

The Crumbling Fiat Empire: A Tale of NYCB and Bitcoin

The recent decline in New York Community Bancorp’s (NYCB) stock price can be traced back to several factors including a drop in profits, loan losses, and regulatory pressure. As CEO Thomas Cangemi stated, “It’s a secular change in the use of downtown real estate.” Despite these challenges, Bitcoin continues to rise in value, demonstrating its resilience against traditional monetary systems. In the ever-changing landscape of traditional finance, the latest headlines surrounding New York Community Bancorp (NYCB) serve as a stark reminder of the fragility inherent in our current financial system.…

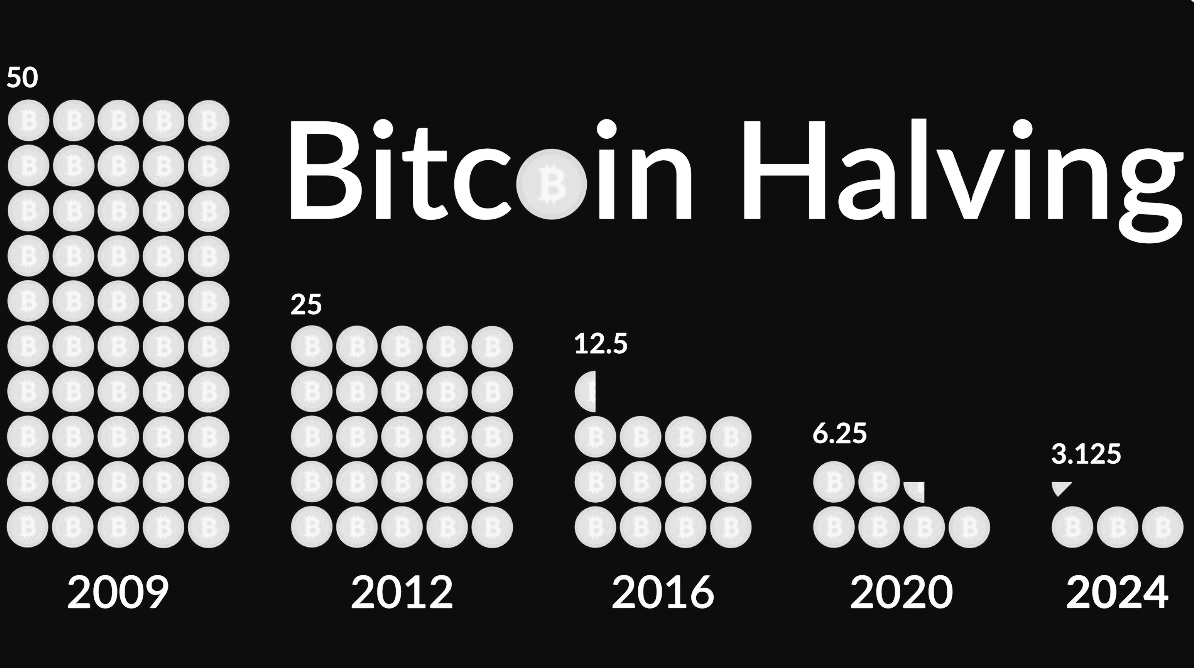

Halving, Mining & Price: The Intertwined Fate of Bitcoin

The fate of #Bitcoin’s price, mining profits, and the overall health of the crypto ecosystem are intertwined as the next halving event looms in Apr 2024. Will the halving drive up prices or squeeze out less efficient players? Keep watch with us.

BlackRock & Co.: Pioneering Bitcoin’s Integration into Traditional Finance

Greetings, fellow Bitcoinners! It’s an exciting day in our beloved crypto space, as BlackRock and its peers take center stage in the quest for mainstream acceptance. As regulatory clarity emerges, institutional giants see new opportunities to bring Bitcoin closer to traditional finance while ensuring investor protection. Larry Fink, the CEO of BlackRock, has recently expressed his views on Bitcoin, positioning it as a commodity instead of a traditional currency. This perspective highlights the significance of appreciating Bitcoin from an investment viewpoint, which is a notion that finds agreement among numerous…

The Bitcoin ETF Race: A Tug-of-War Between Inflows and Outflows

Grayscale Bitcoin Trust (GBTC), which began January 2021 with a holding of 619,000 $BTC, has seen a decrease to 478,000 BTC as of now. While Grayscale holdings dwindle, financial giants Blackrock and Fidelity have stepped into the scene, acquiring a staggering 134,357 BTC ($5.7 billion) for their respective Spot Bitcoin ETFs. This sudden increase raises questions about whether everyday crypto enthusiasts will even have access to Bitcoin if large institutions snap it all up! Let us take a closer look at the state of the ETF race using 3 revealing…

The Identity Issue: COPA vs. Craig Wright – A Bluff Called Out in the High Court

Unraveling the truth behind the Satoshi mystery: Read the analysis on the explosive revelations from Day 1 of the COPA vs. Craig Wright trial.

Debunking the Misconception: Inflation Falling Doesn’t Mean Lower Grocery Prices

Inflation down≠cheaper groceries. Why do grocery prices remain high despite falling inflation? It’s a question influencers & pubs keep asking.