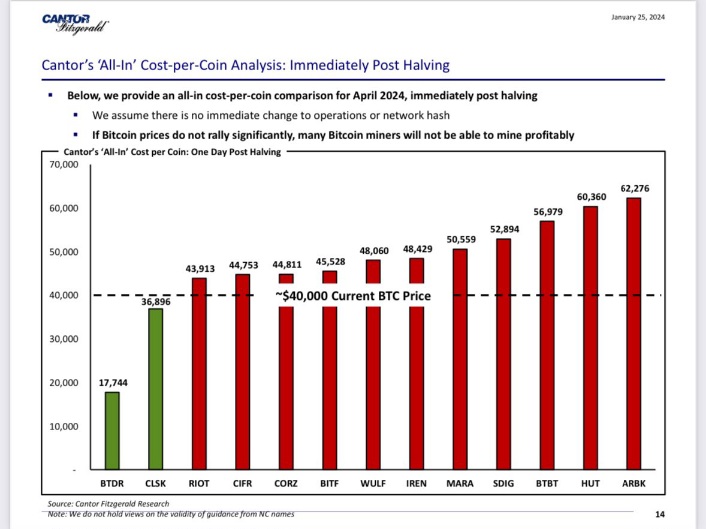

As the Bitcoin halving event approaches, some US-based miners may become unprofitable due to increased operating costs.

As the Bitcoin halving event looms in April 2024, a fascinating narrative unfolds around the interconnected future of Bitcoin’s price, mining profits, and the overall health of the crypto ecosystem. According to a recent report by Cantor Fitzgerald, the halving may significantly affect the profitability of several leading public Bitcoin miners, leaving some struggling to stay afloat. Amongst the most vulnerable ones are Argo Blockchain and Hut 8 Mining, whose “all-in” cost per Bitcoin is projected to surpass $60,000 post-halving.

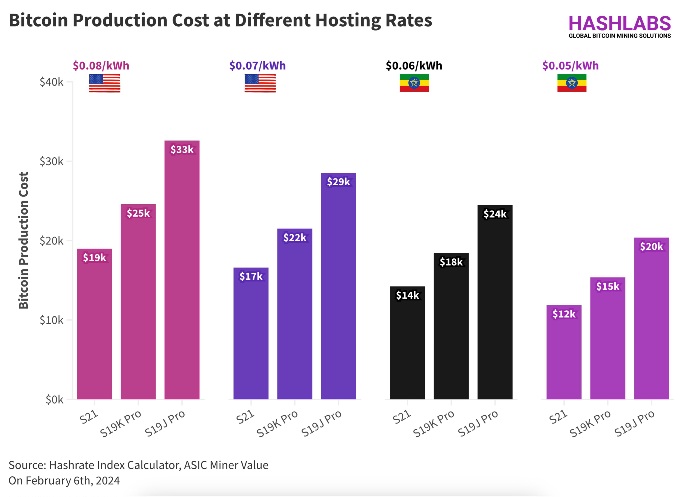

What does this mean? As Bitcoin’s issuance gets cut in half during the halving, so does the income earned by miners making it crucial for them to offset these losses through other means like cutting expenses or increasing efficiency. However, many U.S.-based miners find themselves in precarious situations due to high electricity costs. Those operating at $0.07 kWh and above face the grim prospect of becoming unprofitable after the halving.

Interestingly enough, data shows an uptick in Bitcoin sales by miners to exchanges, signaling strategic preparations for the incoming profit crunch. In January 2024 alone, miner outflows were triple compared to inflows into miner wallets. These coins primarily serve two purposes: shoring up balance sheets against leaner days and funding facility upgrades necessary to compete in an ever-evolving landscape.

However, this massive sell-off has significantly impacted both liquidity and price discovery mechanisms. In fact, it even caused a brief drop in Bitcoin prices down to around $39,000. At present, Bitcoin is approaching the $43,000 mark, garnering considerable attention during the Asian trading session.

The question remains whether the surge in ETF applications and MicroStrategy’s potential buy-in can drive a rally towards $50,000. We’ll have to wait and see if the upcoming halving event will contribute to generating some FOMO (fear of missing out) sentiments..

Despite this momentary hurdle, analysts predict that miners will persist in shedding their reserves throughout the coming months as they ready themselves for the inevitable reductions in block rewards come April.

With lessened block rewards but potentially increased competition among survivors, one must ponder whether the current network difficulty can adapt swiftly enough to accommodate such seismic shifts. Otherwise, we risk observing stagnation within the mining sector should the price fail to compensate for diminished revenues. If history serves us well, however, past halvings usually resulted in upward trajectories for Bitcoin’s value, providing hope for miners bracing themselves for what lies ahead.

Only time will tell how effectively the remaining miners can navigate these treacherous waters while preserving the delicate equilibrium upon which our beloved cryptocurrency relies. Rest assured, dear readers, turbulent seas make for captivating stories!