Uncovering the latest in corporate Bitcoin investment! Our newest blog post explores how MicroStrategy’s recent Q4 earnings reveal falling revenues yet skyrocketing BTC reserves

Category: Market Watch

Navigate the crypto markets like a pro, your go-to resource for trading excellence. Explore comprehensive insights into trading strategies, delve into the psychology of the market, and master the art of Technical Analysis—whether it’s Bitcoin, cryptocurrency or the stock markets, we’ve got you covered. Where trading intelligence meets the pulse of the digital economy.

ETFs Approved by SEC Impact Miners’ Reserves

Bitcoin miners are selling reserves since ETF approvals led to $1 bil. in BTC moves to exchanges. Main drivers include preparations for the Bitcoin halving, covering operation costs, and securing profits. Increased institutional involvement supports a positive outlook for miners. Recently, Bitcoin miners have been selling their asset reserves or using them to upgrade their capacity due to increasing inflows to cryptocurrency exchanges. A report from Bitfinex Alpha Market indicates that Bitcoin ETF approvals by the US Securities and Exchange Commission (SEC) have had an impact on miners’ reserves. As…

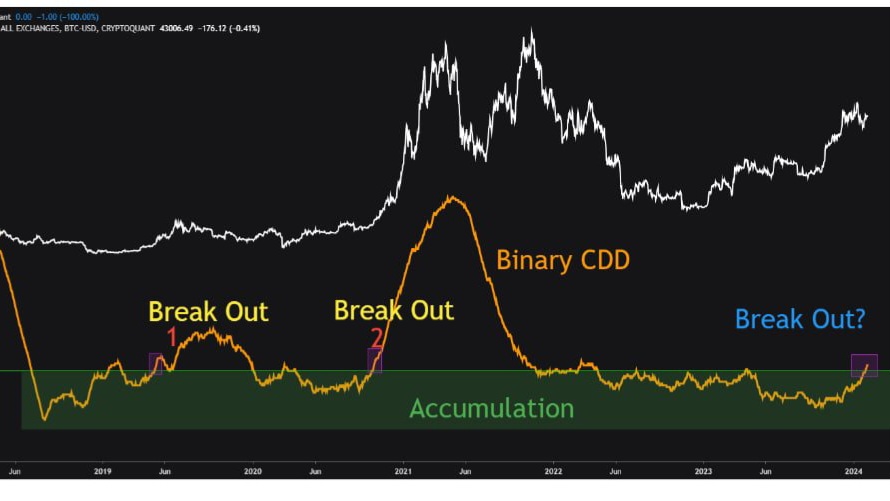

Breaking Free: A Bitcoiner’s Analysis of the Bullish Breakout in the CDD Metric

Greetings fellow bitcoin enthusiasts! It seems like we might just be on the cusp of another exciting chapter in the world of bitcoin as the Binary Coin Days Destroyed (CDD) indicator breaks out of its accumulation zone. According to recent on-chain data, this development could potentially signal the return of a powerful rally for our beloved cryptoasset. For those unfamiliar with the concept, ‘coin days’ refer to the amount of time a single bitcoin remains untouched within the blockchain. Once moved, these so-called ‘coin days’ cease to exist; hence, the…

The Bitcoin ETF Race: A Tug-of-War Between Inflows and Outflows

Grayscale Bitcoin Trust (GBTC), which began January 2021 with a holding of 619,000 $BTC, has seen a decrease to 478,000 BTC as of now. While Grayscale holdings dwindle, financial giants Blackrock and Fidelity have stepped into the scene, acquiring a staggering 134,357 BTC ($5.7 billion) for their respective Spot Bitcoin ETFs. This sudden increase raises questions about whether everyday crypto enthusiasts will even have access to Bitcoin if large institutions snap it all up! Let us take a closer look at the state of the ETF race using 3 revealing…

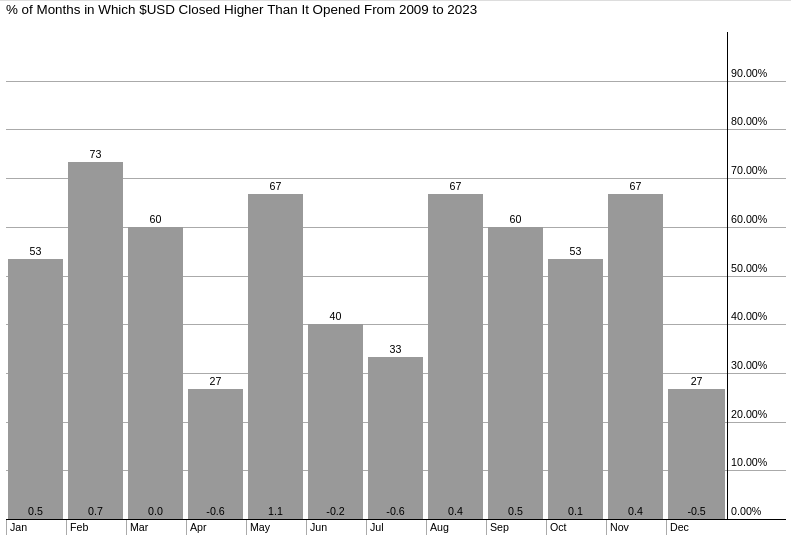

The Seasonal Strength of the US Dollar in February

💡February tip: Historically, the US Dollar has shown seasonal strength 73% of the time from 2009-2023, averaging 0.7% gains.

Debunking the Misconception: Inflation Falling Doesn’t Mean Lower Grocery Prices

Inflation down≠cheaper groceries. Why do grocery prices remain high despite falling inflation? It’s a question influencers & pubs keep asking.

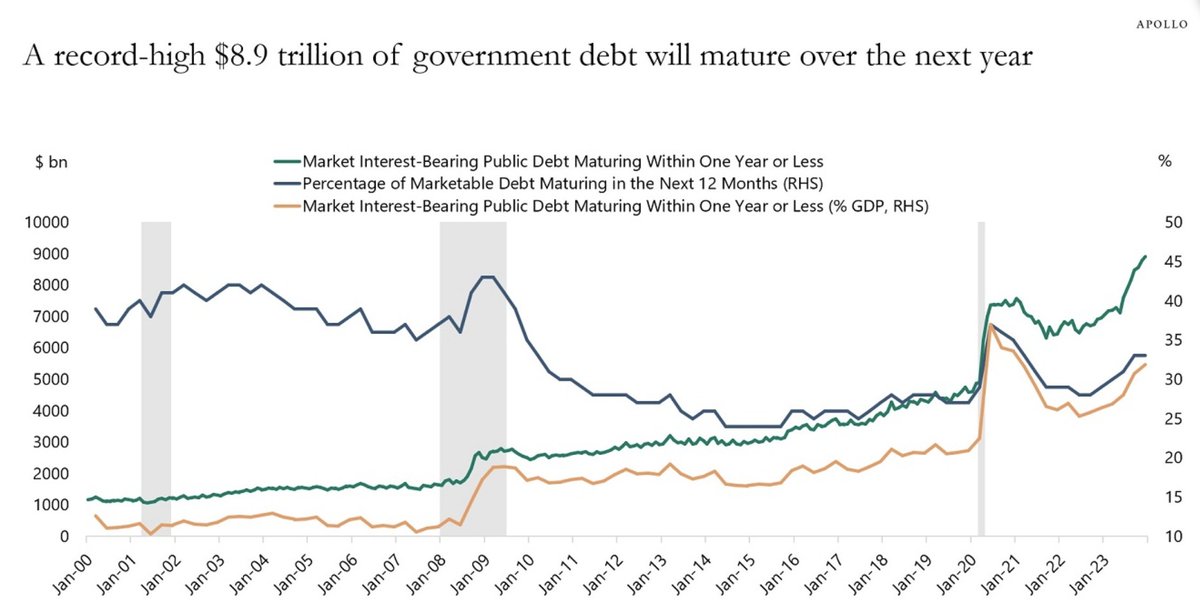

Debt Storm: Who Will Fund the US Government’s Skyrocketing Deficit?

As the US government faces a massive amount of debt, the Fed may need to implement inflationary measures to fund the debt. However, this could lead to rising interest expenses and further strain on the economy.

Navigating the Largest Ever Bond Auctions Amidst Economic Challenges

In a landmark decision aimed at addressing the burgeoning budget deficit, the United States Treasury recently unveiled plans to conduct the biggest-ever series of bond auctions. With the headline event being a colossal five-year, $70 billion auction scheduled for April, stakeholders eagerly await forthcoming announcements regarding increased auction sizes across multiple maturity categories within the upcoming three-month period, specifically concerning two-year and five-year treasury notes. In recent weeks, the U.S. Treasury held auctions for these maturities at their highest volumes ever – $60 billion for two-year notes and $61 billion…

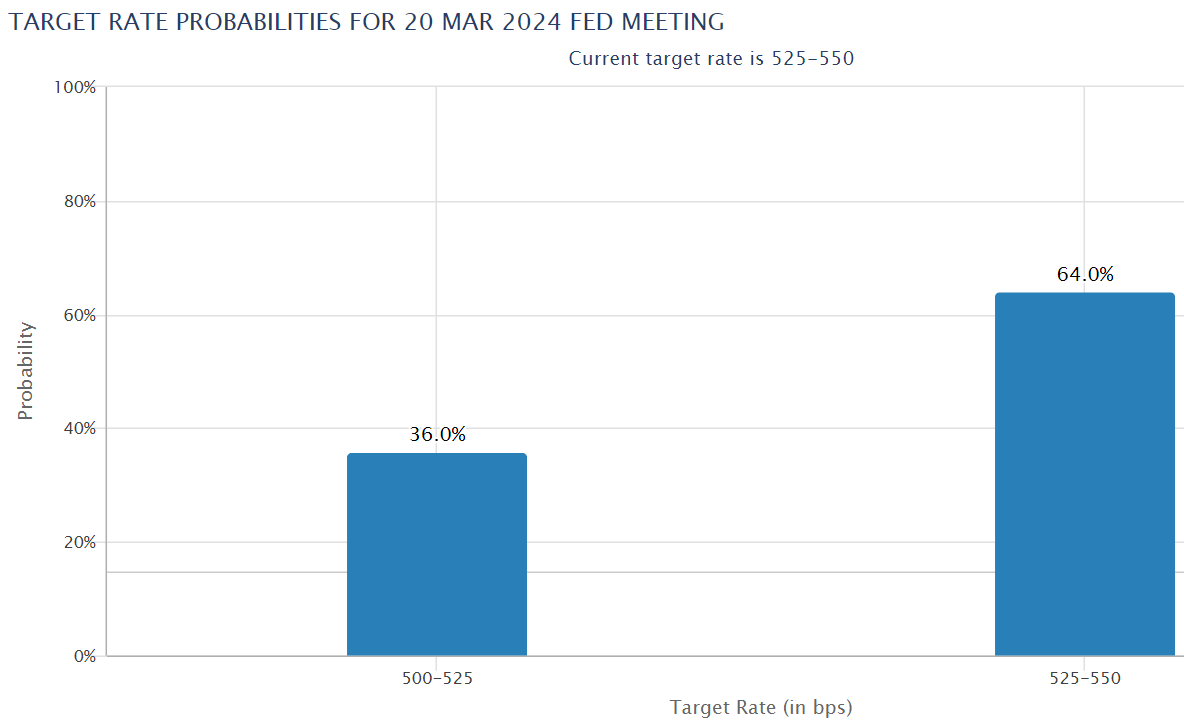

Understanding the Current Dip in Bitcoin Price Amid Changing Expectations for Fed Rate Cuts

Understanding #Bitcoin’s recent dip: Traders reduce March Fed rate cut bets; however, expectations for May & beyond still signal potential growth.

Stablecoin Market Dynamics 2023: USDT Surges, USDC Declines.

Tether’s USDT stablecoin has seen massive growth in 2023, with its market cap up $20+ billion. USDT dominates with 80% market share, favored by institutions & emerging markets. Trust & reliability drive its success. #cryptocurrency #stablecoin #tether