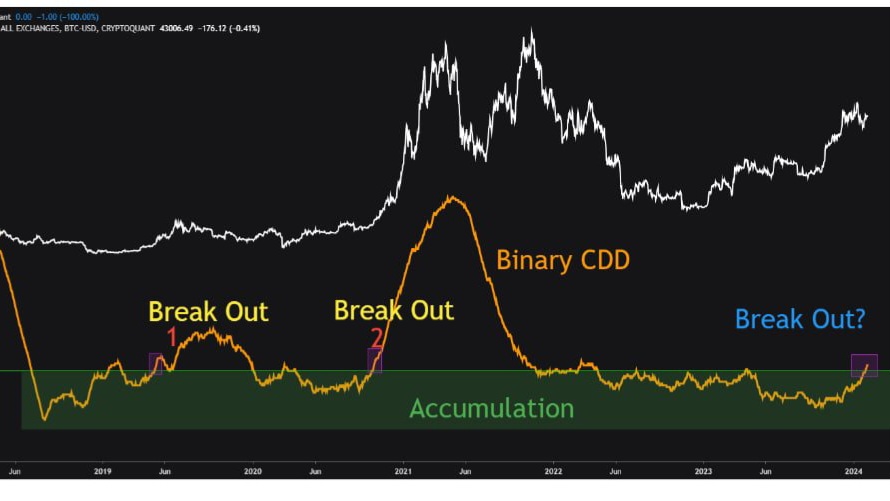

Greetings fellow bitcoin enthusiasts! It seems like we might just be on the cusp of another exciting chapter in the world of bitcoin as the Binary Coin Days Destroyed (CDD) indicator breaks out of its accumulation zone. According to recent on-chain data, this development could potentially signal the return of a powerful rally for our beloved cryptoasset.

For those unfamiliar with the concept, ‘coin days’ refer to the amount of time a single bitcoin remains untouched within the blockchain. Once moved, these so-called ‘coin days’ cease to exist; hence, the term ‘destroyed.’ By comparing the present CDD against historical averages, the Binary CDD helps us determine if there’s heightened activity among long-term holders (LTHs) – those hodlers who patiently stockpile substantial quantities of coin days.

Interestingly enough, when the CDD spikes above normal levels, it typically points toward enhanced movement by the LTH community. Over the course of prior upturns, LTH action tends to increase alongside rising prices, whereas downturn phases see reduced LTH engagement. Our resident expert Mignolet noted striking parallels between earlier bull runs and the prevailing situation in his insightful Twitter thread.

According to Mignolet’s research, the growing frequency of elevated Binary CDD readings hints at a strengthening probability of an imminent bullish trend. Furthermore, he emphasizes the importance of tracking the 182-day moving average of the Binary CDD, highlighting how breaking away from the accumulation zone often leads to prolonged price surges in bitcoin. If the Binary CDD consistently exceeds this critical level, it raises the likelihood of a robust upward price cycle taking shape.

Indeed, several other indicators corroborate this optimistic viewpoint. Demand for bitcoin continues to grow, and whales appear increasingly eager to amass larger portions of the precious currency. Recently published data reveals that new whale wallets (holding between 1k – 10k BTC) have risen by approximately 2.5%, overshadowing a minor decline in mid-sized address count (100-1k BTC).

At press time, bitcoin hovers near the $42,400 threshold following a brief dive beneath $42,200 during the weekend. With all things considered, let’s remain hopeful that this auspicious breakout will herald a prosperous new stage for bitcoin, bringing fresh opportunities and success stories along the journey. Happy hodling, dear readers!