Grayscale Bitcoin Trust (GBTC), which began January 2021 with a holding of 619,000 $BTC, has seen a decrease to 478,000 BTC as of now. While Grayscale holdings dwindle, financial giants Blackrock and Fidelity have stepped into the scene, acquiring a staggering 134,357 BTC ($5.7 billion) for their respective Spot Bitcoin ETFs. This sudden increase raises questions about whether everyday crypto enthusiasts will even have access to Bitcoin if large institutions snap it all up! Let us take a closer look at the state of the ETF race using 3 revealing…

Category: Featured

The Identity Issue: COPA vs. Craig Wright – A Bluff Called Out in the High Court

Unraveling the truth behind the Satoshi mystery: Read the analysis on the explosive revelations from Day 1 of the COPA vs. Craig Wright trial.

Debunking the Misconception: Inflation Falling Doesn’t Mean Lower Grocery Prices

Inflation down≠cheaper groceries. Why do grocery prices remain high despite falling inflation? It’s a question influencers & pubs keep asking.

Join the Digital Gold Rush: Building a Prosperous Future with Bitcoin

Once upon a time, there was a thing called fiat currency – a system built on debt and faith, where governments printed money out of thin air and people accepted it as payment for goods and services. But as we all know, every Ponzi scheme eventually collapses under its own weight, unable to sustain itself when the music stops. And that’s exactly what fiat is – a global Ponzi scheme that has been artificially propped up for decades. Tapering, or gradually reducing the amount of new money created by central…

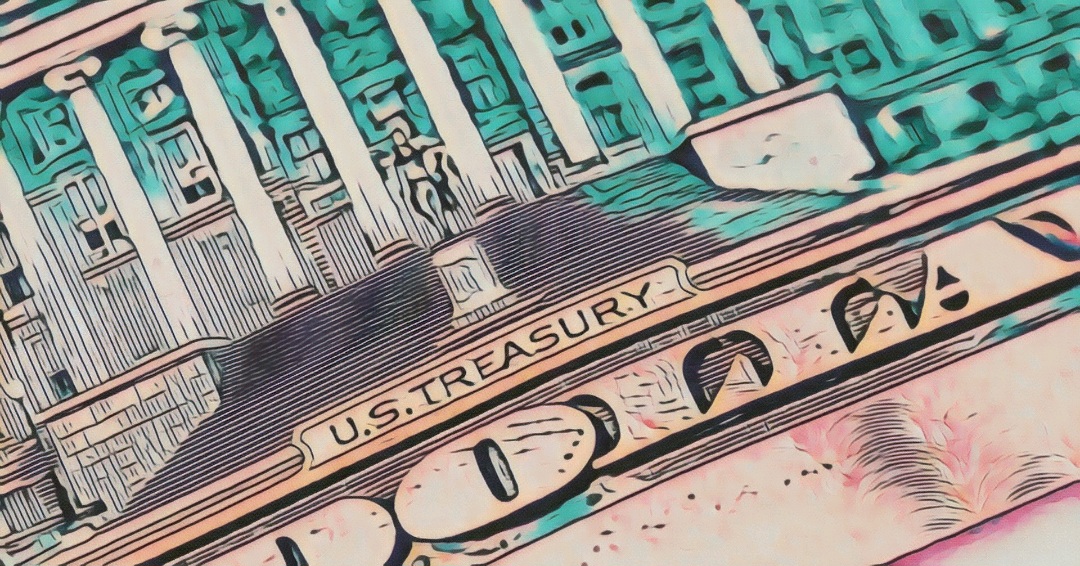

Navigating the Largest Ever Bond Auctions Amidst Economic Challenges

In a landmark decision aimed at addressing the burgeoning budget deficit, the United States Treasury recently unveiled plans to conduct the biggest-ever series of bond auctions. With the headline event being a colossal five-year, $70 billion auction scheduled for April, stakeholders eagerly await forthcoming announcements regarding increased auction sizes across multiple maturity categories within the upcoming three-month period, specifically concerning two-year and five-year treasury notes. In recent weeks, the U.S. Treasury held auctions for these maturities at their highest volumes ever – $60 billion for two-year notes and $61 billion…

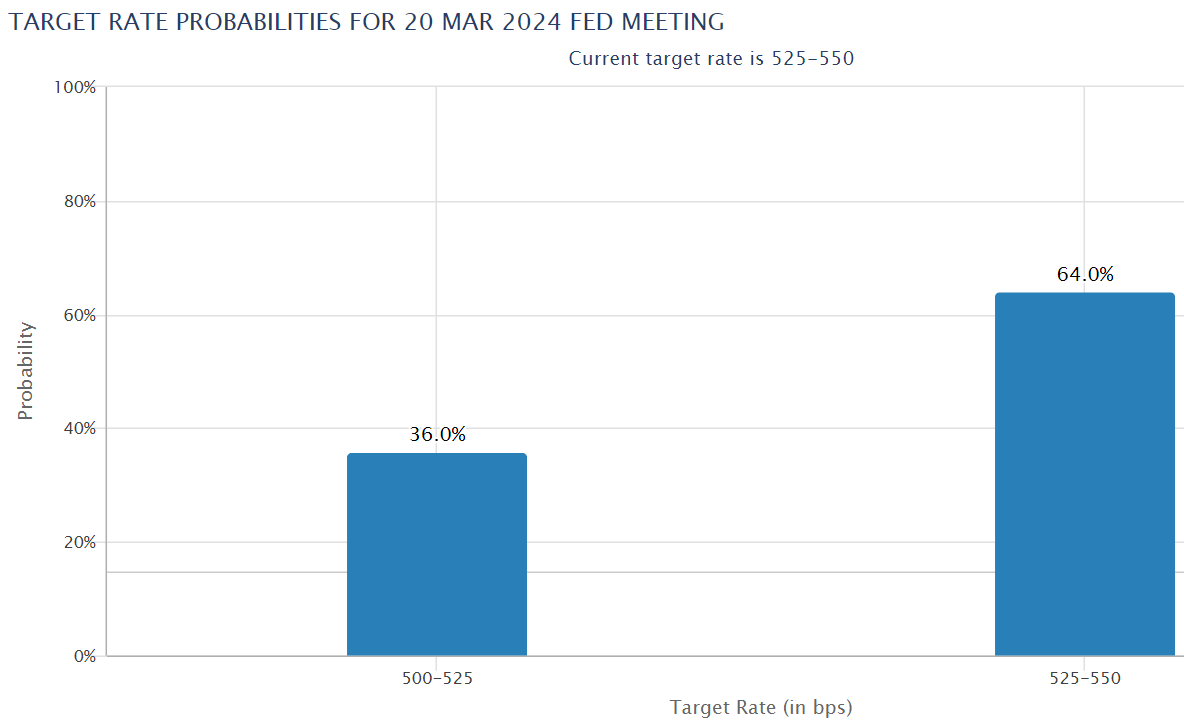

Understanding the Current Dip in Bitcoin Price Amid Changing Expectations for Fed Rate Cuts

Understanding #Bitcoin’s recent dip: Traders reduce March Fed rate cut bets; however, expectations for May & beyond still signal potential growth.

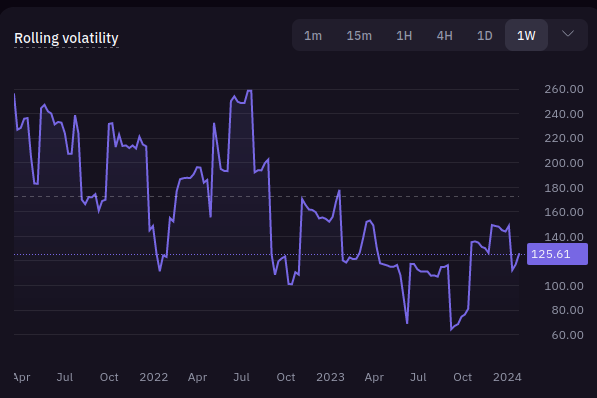

Navigating Crypto Calm: Unpacking Bitcoin’s Declining Weekly Rolling Volatility Post ETF Launch.

Navigating BTC Calm: Unpacking Bitcoin’s Declining Weekly Rolling Volatility Post ETF Launch & Its Implications for Long-Term Holders and Traders Alike.

Bitcoin Halving Price Trends and Market Dynamics

Bitcoin halving on the horizon! Predictable mid-cycle top & pullbacks of up to 30% precede this event historically. Recent 20% dip might just be another buying opportunity. With miners unloading large volumes, #Whales sense an entrance. Could history repeat itself? Stay tuned! 🔍🚀 #BitcoinNews #BTC”

Crypto Recovery Company Discovers Flaw in Millions of Bitcoin Wallets

Critical vulnerability discovered in BitcoinJS library, putting millions of wallets at risk. Unciphered, a crypto recovery company, accidentally uncovered the flaw while attempting to recover a client’s lost Bitcoin wallet.

Grayscale’s GBTC Premium Surge: Spot Bitcoin ETF Quest

Grayscale’s GBTC premium hits a two-year high at -10.35%, sparking optimism amid SEC negotiations. The crypto community awaits potential approval in 2024 for a Spot Bitcoin ETF.