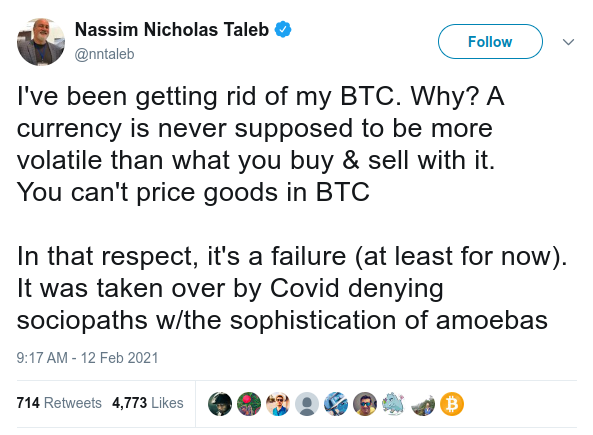

Three years ago, famed statistician and former Wall Street trader Nassim Nicholas Taleb took to Twitter, proclaiming he had sold off his Bitcoins. His reasoning? According to him, a currency should never be more volatile than the goods and services it buys and sells. Furthermore, he criticized the cryptocurrency for being controlled by what he described as “Covid denying sociopaths with the sophistication of amoebas.” At the time, Bitcoin was trading at approximately half its current price.

Well, Three years later, it seems safe to say that Mr. Taleb spoke too soon once again! Since his dismissive tweet, Bitcoin has continued its relentless march upward, shattering previous resistance levels and cementing its place as a force to be reckoned with in the world of finance.

Let’s revisit those points raised by Taleb and see how Bitcoin has fared in light of his criticism:

- Volatility vs. Goods and Services: While Bitcoin may still be considered volatile compared to traditional currencies, its growing acceptance as a viable means of exchange for goods and services represents a positive step forward towards broader mainstream adoption. Additionally, as more institutional players adopt Bitcoin, market liquidity increases, potentially reducing volatility over time.

- Control by Sociopaths: It’s unclear whom exactly Taleb was referring to when labeling them “sociopaths,” but it’s worth noting that the Bitcoin network operates independently of central authorities or influential personalities. Decisions concerning protocol upgrades or improvements are determined collectively by developers and node operators based on technical merits rather than political agendas or ideologies. Thus, casting blanket accusations without substantiation does little to detract from Bitcoin’s decentralized nature.

As for the current state of Bitcoin, here are some updates since Taleb’s critical assessment:

- Institutional Adoption: Wall Street institutions have recently launched Bitcoin ETFs, indicating a growing acceptance of cryptocurrency in traditional finance. Additionally, major corporations and financial institutions continue to embrace Bitcoin

- Mainstream Recognition: Increased media coverage highlighting Bitcoin’s performance and potential benefits has led to growing public awareness and acceptance.

- Continued Innovation: Development efforts focusing on improving scalability, privacy, and interoperability ensure that Bitcoin stays ahead of competitors vying for dominance in the burgeoning digital asset sphere.

To sum up, Nassim Nicholas Taleb’s critique of Bitcoin aged poorly in just three years, reinforcing the notion that predicting the trajectory of innovative technologies can prove challenging for even the brightest minds. Meanwhile, Bitcoin sails steadily forward, impervious to skeptics and critics alike, reminding us once again why it deserves its title as digital gold. Long live the king!

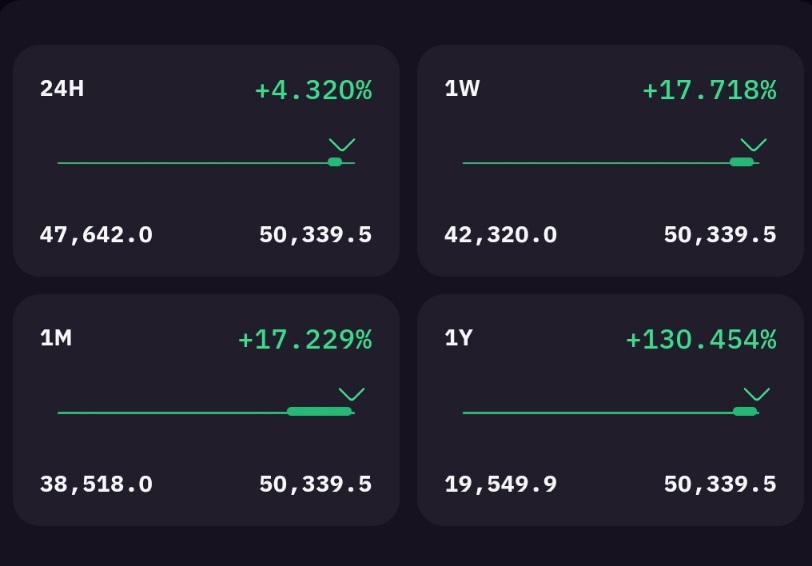

Bitcoin price prediction: $50,000 Bitcoin Milestone Reached – Will $57,500 Be Next? Analysis and Outlook