The recent decline in New York Community Bancorp’s (NYCB) stock price can be traced back to several factors including a drop in profits, loan losses, and regulatory pressure. As CEO Thomas Cangemi stated, “It’s a secular change in the use of downtown real estate.” Despite these challenges, Bitcoin continues to rise in value, demonstrating its resilience against traditional monetary systems.

In the ever-changing landscape of traditional finance, the latest headlines surrounding New York Community Bancorp (NYCB) serve as a stark reminder of the fragility inherent in our current financial system. As NYCB grapples with a multitude of challenges – including substantial losses, dwindling investor confidence, and the looming specter of a bank run – one cannot help but ponder the merits of decentralized alternatives like Bitcoin.

Over the course of merely a week, NYCB’s shares experienced a staggering decline of 60%, erasing vast swaths of value virtually overnight. This dramatic descent can be traced back to several factors, among them being the acquisition of assets belonging to the now-defunct Signature Bank, which thrust NYCB’s asset base beyond the $100 billion threshold, thereby mandating higher capital reserves and constraining their ability to extend new credits per regulatory requirements. Moreover, the shift towards remote work has precipitated significant declines in commercial property values, causing rippling effects throughout the bank’s balance sheet.

To exacerbate matters, rating agency Moody’s recently relegated NYCB’s credit standing to “junk” territory, citing concerns over potential weakening of depositor trust. Given that unsecured depositors constitute nearly half of the institution’s total deposit base, such apprehensions may very well prove prescient. Indeed, should these individuals panic and withdraw funds en masse, the resultant bank run could spell disaster even for an organization of NYCB’s stature.

These events offer us yet another illustration of how intricate and interconnected today’s monetary systems truly are, subject to various externalities often outside any single entity’s control. In light of these circumstances, many observers might find solace in the relative simplicity and immutability offered by cryptocurrencies such as Bitcoin.

While it remains true that no investment avenue is entirely devoid of risks, digital currencies possess qualities that distinguish them fundamentally from conventional instruments. For starters, Bitcoins do not rely upon central authorities nor third parties for validation; instead, transactions are verified collectively through consensus algorithms executed across thousands of nodes worldwide. Furthermore, unlike fiat currencies that can be manipulated at whim by governments seeking short-term economic relief, Bitcoin maintains a predetermined supply cap built directly into its underlying codebase.

Consequently, fears regarding inflationary pressures driving down purchasing power hold little sway over Bitcoin’s long-term prospects. Quite paradoxically, episodes involving struggling institutions like NYCB arguably bolster the argument for adopting decentralized solutions capable of circumventing human fallibility and institutional frailty.

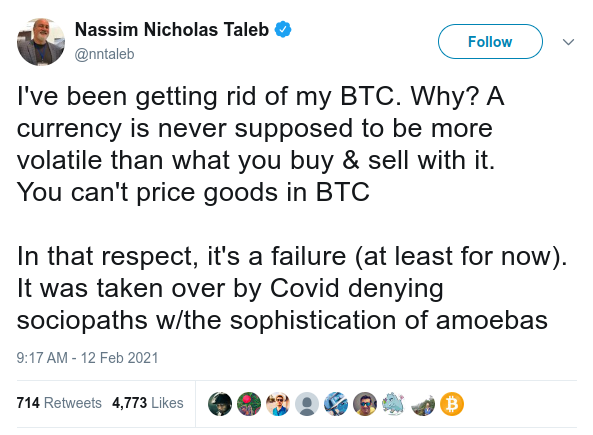

It is worth noting here that numerous detractors once dismissed Bitcoin as nothing more than ephemeral hype, fated to fade away much like previous attempts at virtual currencies before it. Yet, despite facing skepticism and scorn, Bitcoin continues to thrive, garnering mainstream recognition while establishing itself as a viable alternative store of value and medium of exchange.

As we bear witness to the trials and tribulations afflicting entities such as NYCB, let us remember that there exists a realm where resilience, transparency, and predictability reign supreme. Amidst the chaos of collapsing empires, perhaps it is time we consider embracing the stability promised by decentralization – embodied perfectly within the formidable construct known as Bitcoin.