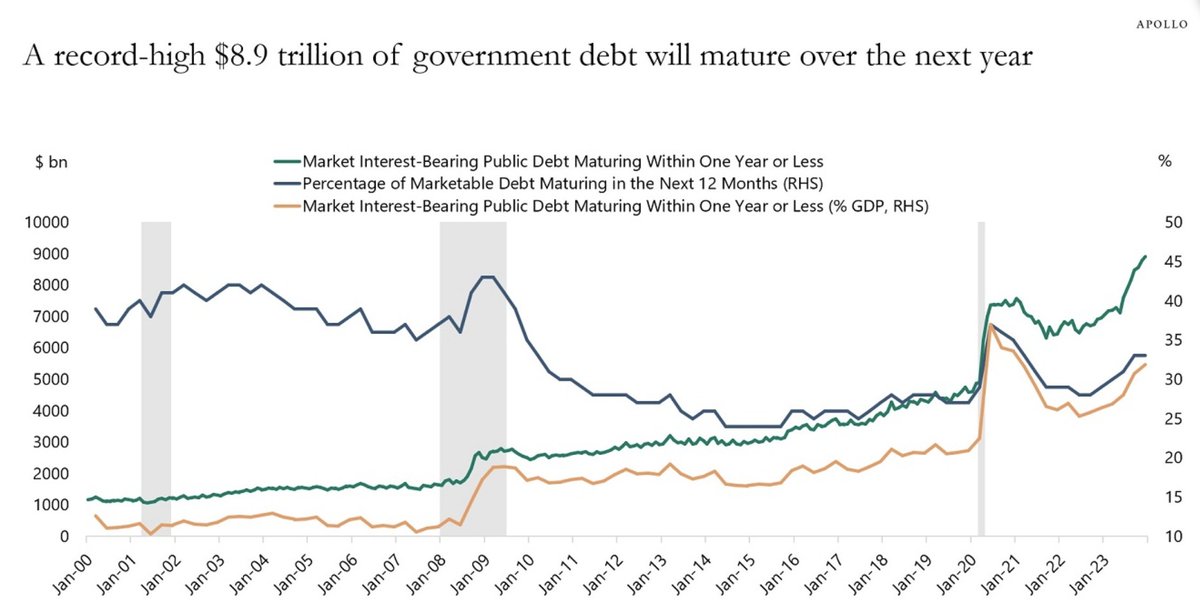

As we approach 2024, the US government faces an unprecedented challenge: a staggering $8.9 trillion in government debt is set to mature within the next year.

Simultaneously, the government deficit for 2024 is projected to reach $1.4 trillion, meaning that someone will need to purchase more than $10 trillion in US government bonds.

This figure represents almost one-third of all outstanding US federal debt at present, leaving many to wonder—who will foot this massive bill?

One potential answer lies with the Federal Reserve (Fed), which is anticipated to begin cutting interest rates in the near future.

However, lower rates may not provide enough incentive for investors to absorb such vast quantities of debt securities. Consequently, the Fed might once again turn to more inflationary quantitative easing (QE) programs to stimulate demand.It’s important to acknowledge the impact of rising interest rates on US debt.

As illustrated below, debt service costs for the US government have more than doubled since the Fed began increasing interest rates. With mounting debt and widening deficits, servicing this burden will only become increasingly difficult.

Currently, the US federal budget deficit stands at approximately 8% of GDP—one of the highest ratios globally. Other countries like India and China face similarly daunting figures, exceeding 7%.

But what does this mean for the average citizen or investor? In essence, governments must either reduce spending, raise taxes, or rely on central banks to finance their shortfalls. Each option presents its own challenges and consequences.

For instance, excessive borrowing can lead to spiraling interest payments, crowding out private investment, devaluing currency, or even triggering hyperinflation. On the other hand, drastic cuts in public expenditure could slow economic growth and exacerbate social inequality.

So, who will bear the brunt of funding these enormous debts? Ultimately, it will likely involve a combination of domestic and foreign investors, financial institutions, and central banks.

Nevertheless, navigating this storm requires careful consideration from policymakers regarding both monetary and fiscal strategies. Failure to do so risks plunging economies into uncharted waters filled with uncertainty and potentially perilous outcomes.