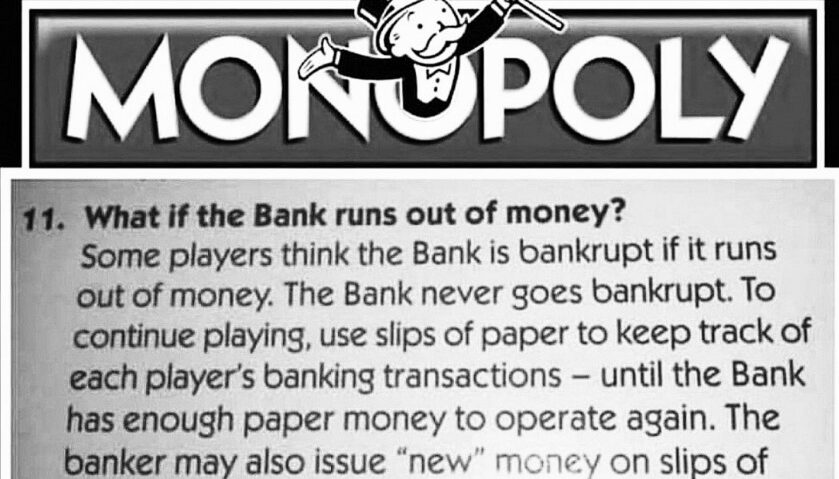

When discussing finance, economics, and currency systems, few analogies resonate quite as profoundly as the classic board game Monopoly. Developed in the early 1900s, this seemingly simple game offers valuable insights into the intricate mechanics governing real-world capital markets. Recently, I came across Rule #11 of Monopoly, which addresses the situation where the bank runs out of money. Upon reflection, I realized that this scenario encapsulates several essential principles related to central banks, fiat currencies, and inflation.

First, consider the statement that the bank “never goes bankrupt.” In essence, this principle mirrors the concept of “too big to fail,” wherein powerful institutions receive bailouts rather than being allowed to collapse under the weight of their debts. Such practices contribute to moral hazards and perpetuate unsustainable economic policies, ultimately harming everyday citizens.

Next, when the bank runs out of cash, the rules dictate that players utilize slips of paper to record transactions. Eventually, when sufficient funds become available, new money is printed on regular sheets of paper. Remarkably, this process echoes modern central banks’ behavior, which frequently resort to quantitative easing measures, effectively creating fresh reserves of digital dollars, euros, pounds, etc., thereby devaluing existing units held by individuals and businesses.

Perhaps most importantly, this analogy highlights the insidious nature of inflation, referred to in Monopoly as a “hidden tax.” When central banks increase the money supply without corresponding increases in goods and services, purchasing power decreases, resulting in higher prices for consumers. Consequently, people endure a gradual erosion of their savings, experiencing diminished buying power despite having the same nominal sums stored away.

Given these striking parallels between a beloved board game and actual financial systems, one might reasonably conclude that society functions much like a grand-scale version of Monopoly. Unfortunately, unlike the controlled environment presented in the game, navigating life’s complexities requires confronting unpredictable variables and external factors that amplify risks and complicate decision-making processes. Nevertheless, understanding fundamental concepts derived from seemingly innocuous sources provides context and clarity, enabling better-informed choices regarding finances, investments, and overall prosperity.

Therefore, as we examine the lessons imparted by Monopoly, let us appreciate the wisdom they convey. Capital markets function similarly to this iconic board game, complete with built-in advantages favoring certain participants and inherent dangers threatening the unwary. Most crucially, however, remember that inflation silently siphons your wealth, demanding constant vigilance and proactive strategies to preserve and enhance your net worth amidst fluctuating economic conditions. Ultimately, comprehending these dynamics empowers us to thrive financially and navigate the capricious waters of international commerce more confidently.