Rolling volatility, also known as historical volatility, is a statistical measure used to quantify the price fluctuations of an asset over a specific period of time. In the context of analyzing Bitcoin, rolling volatility helps investors and traders understand the degree of price variability in the cryptocurrency market.

Rolling volatility is typically calculated using a moving window of past data points (e.g., daily closing prices) and comparing them to one another. This allows for the estimation of volatility on a continuous basis, rather than at fixed intervals.

For instance, you might calculate the 30-day rolling volatility by taking the standard deviation of Bitcoin’s daily returns over the previous 30 days. As new data becomes available, the oldest data point is dropped from the calculation, and the most recent data point is added, thus “rolling” the volatility estimate forward in time.There are several reasons why understanding rolling volatility is crucial when analyzing Bitcoin:

Risk management – High volatility implies greater uncertainty and risk associated with holding or trading Bitcoin. By monitoring rolling volatility, investors can better assess their risk exposure and adjust their portfolios accordingly.

Trading strategies – Volatility plays a significant role in many trading strategies, such as options pricing and mean reversion. Traders can use rolling volatility estimates to identify entry and exit points, manage stop losses, and set take profit levels.

Market trends and sentiment – Increased volatility often indicates heightened market activity and emotional responses to news events or other factors driving demand. Conversely, decreasing volatility may suggest that the market is becoming more stable or reaching a consensus on its future direction.

Comparisons with traditional assets – Analyzing Bitcoin’s rolling volatility alongside that of traditional assets like stocks, bonds, or commodities can provide insights into relative risk and potential diversification benefits. Historically, Bitcoin has exhibited much higher volatility compared to these assets, making it both an attractive speculative instrument and a challenging addition to conservative investment portfolios.

Future expectations – While rolling volatility focuses on historical price movements, it can offer clues about future volatility patterns. Periods of high volatility could indicate increased likelihood of further price swings, while lower volatility might imply reduced short-term price action.

However, it is essential to remember that past performance does not guarantee future results, especially in highly volatile markets like crypto.

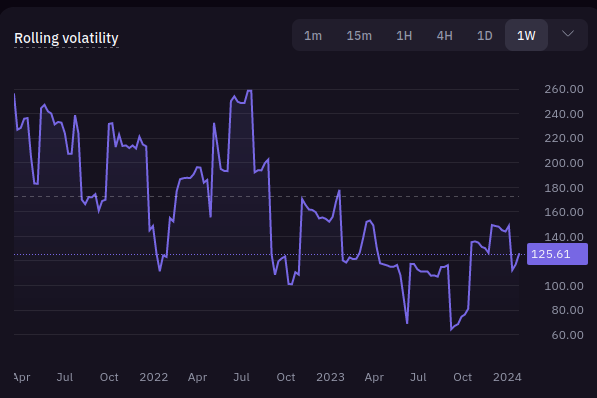

The current weekly rolling volatility for Bitcoin stands at 124.86, indicating a significant decrease in volatility since the peak of 258.6 observed on July 21, 2022, following the approval and launch of a Bitcoin ETF trading on Wall Street. Following the recent approval of ETFs by the SEC, the price of Bitcoin has experienced reduced volatility, with the 11 Spot ETFs attracting approximately $1.15 billion in cumulative inflows since their launch.

Despite the lower volatility, Bitcoin is on track to achieve its fifth consecutive monthly gain, marking its longest winning streak since the pandemic-induced rally of 2020 and 2021. However, even though the current volatility level seems low compared to historical maxima, it remains substantially higher than typical values found in established financial markets. Consequently, investing in or trading Bitcoin necessitates cautious evaluation of risk tolerance, portfolio allocation, and overall market conditions.

A decline in volatility might be perceived positively by long-term holders who favor steady uptrends without extreme price fluctuations. On the other hand, some traders may find decreased volatility unappealing, as it restricts opportunities for swift profits via intraday or swing trades. Notably, the lowest recorded weekly rolling volatility stood at 64.4, occurring on September 7, 2023.

At present, the reduction in volatility implies that the market has grown less uncertain and potentially more stable following the initial euphoria surrounding the Bitcoin ETF. If Bitcoin sustains its upward momentum until the end of the month, it will accomplish its most extended sequence of monthly gains since the six-month period between October 2020 and March 2021, when it attained a record high of nearly $69,000. As always, investors must remain diligent and adjust their strategies appropriately.